Constituents want integrity, transparency, action, and accountability at every level of leadership – values that are inexplicably important when the stakes are high, pressure is on, and tough but fair decisions must be made.

And trust, the ante has been raised in the automotive aftermarket. “While the industry has faced a number of challenging times during its history, the stakes have never been higher to act,” said Larry Montante, a Northeast, PA native and VP of Category Management at Keystone Automotive Operations Inc., a large wholesale distributor of aftermarket parts and accessories in North America.

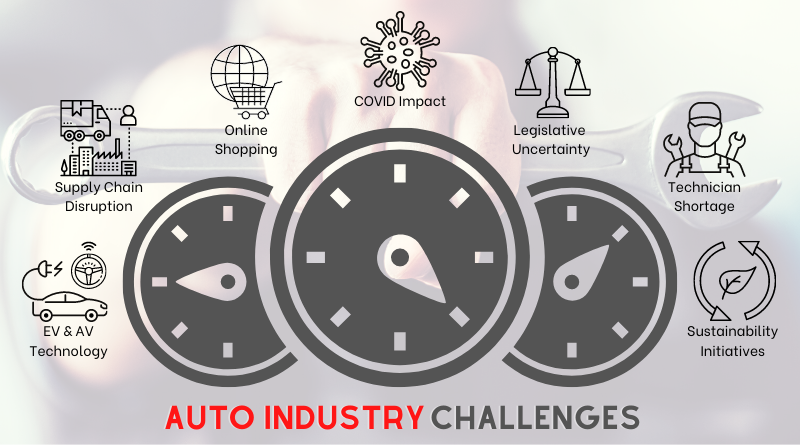

“The rise of EVs and autonomous vehicles, supply chain pressures, channel disruptions, shifts in market trends and technology, how that technology influences commerce, various threats to our entrepreneurial beginnings, red tape, and – oh, by the way – ongoing legislative battles are a big deal, and they impact all of us,” he said.

As such, after 37 years in the industry – with experience that ranges from serving up auto parts from behind the retail counter to leading multiple functional areas of the business in his current position at Keystone, Montante says the calling to serve as a Specialty Equipment Market Association (SEMA) board member has never been stronger.

Recently, Montante granted an interview during which he candidly discussed a range of topics affecting the industry. Part I of the interview, published via The Engine Block, focused on educating general consumers and enthusiasts about why they should have a vested interest at the trade level of the automotive industry. Below is Part II, with an emphasis on you – the industry professional who has been granted the privilege of casting a very important vote by May 25, 2021.

Q: Walk the readership through your professional experience in the automotive aftermarket.

A: Most of my career has been spent pulling products through the supply chain and, because of that, I bring a different perspective, knowledge, and understanding to the role of SEMA board member than most. I can identify with all those functional roles personally – from working behind a retail counter, stocking parts in the warehouse, and handling a portfolio of accounts to managing pricing and analytics, heading up marketing, and now leading a number of departments including category management, inventory management, purchasing, supplier and customer pricing, and product master data. I am also very involved in our marketing and eCommerce areas.

Q: You’ve spent nearly four decades of your professional career serving the automotive industry in a number of ways, across multiple functional areas of the business – from operations to sales and marketing. Why did you decide to toss your name in the hat to become a SEMA board member now?

A: Well, a few key reasons. For one, you reach a certain “season” in your career when you take a step back and want to give back in a different way compared to earlier on. You know, I’ve made Keystone my life for the past 37 years and served in many different ways. I decided to step up my efforts and run for the SEMA board to have a broader impact and to support the industry, my colleagues, and fellow team members.

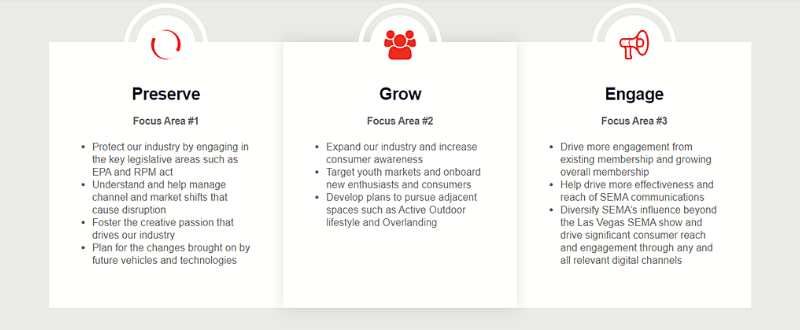

I feel it’s absolutely critical for me to get involved at a higher level, leverage my experience and understanding across a number of different industry channels, and serve in any capacity I can to help preserve the foundation of the automotive aftermarket – to make sure enthusiast parts, styling, and racing stay relevant and thrive.

Q: What are some attributes that make you uniquely qualified to be elected as a SEMA board member?

A: SEMA is representative of all aftermarket members from across all markets and all areas of the business. It’s important for a board member to be able to add real value to any conversation they’re having, and I’m grateful my experience over the years has made me well-rounded enough to do exactly that – to connect personally with the counter person, shop owner, operations, sales and marketing, all the way up the supply chain.

Throughout my career, I’ve remained very connected with the broad user base that sells and installs parts and accessories to the consumer, which has presented opportunities for me to lead and execute multiple tech-based initiatives throughout my career. Over the years, I’ve been a vocal driving force of necessary change within the company as it relates to the ongoing development of digital tools and solutions, most recently an omnichannel program that connects consumers with aftermarket manufacturers and a qualified installation source. .

Varied experience has allowed me to help Keystone evolve organizationally from a family-owned business under Joe Amato, through several aggressive, growth-minded private equity ownerships, and now as a division of LKQ Corp.

Q: The automotive industry has faced a number of significant challenges throughout its storied history – from ever-tightening regulations since the 70s to gas shortages, inflation, and recessions. What is prompting you to say the stakes are higher now than ever before?

A: Over the past few years we have seen a few very large companies pursue the SEMA space more aggressively and apply their overarching consumer products approach. This has been accelerated by the pandemic, as eCommerce proved to be a go-to option for consumers. Coupled with the reach and influence of social media, these companies can have a lasting impact on what consumers are exposed to and how they purchase.

Think about how Big Tech has the power and reach to make changes on a dime that can have far-reaching impacts. Some of my concern is how many entrepreneurial brands have become dependent on these channels, so if and when those said changes are made on a dime, a lot of brands – and, subsequently, their product lines – are at large risk.

The truth is, I don’t think that on any given day, a Big Tech company is going to care about the parts our industry was built on. So, while we must be supportive of equal opportunity, if we don’t keep a watchful eye on these types of shifts, then we could eventually be faced with a very consolidated and eroded manufacturer and retailer/installer base that is not made up of product vision, nor an enthusiast and entrepreneurial mindset or drive.

At a base level, that means industry leadership must make a concerted effort to educate legacy part manufacturers on how to pivot and lessen the risks.

Q: Pandemic aside, the auto industry is experiencing massive change. In the past decade, there have been an unprecedented number of private equity companies making investments; there’s a clear technician shortage; companies are still experiencing significant supply chain issues; and the rise of EVs, autonomous vehicles, and 5G tech will undoubtedly impact the industry at large, both positively and negatively.

What do you consider to be the top threats/opportunities facing the specialty parts aftermarket over the next five years?

A: These thoughts aren’t necessarily in rank order since they are very different and would have varied impact over separate timelines.

- Vehicle trends and technology shifts, including electrification, ADAS, autonomous vehicles, and other emerging technologies will reshape the platforms, as well as the way vehicles are configured and used.

- Legislation/regulation will impact vehicle configuration, modification, and the performance market.

- Channel/technology shifts are key. As the power, influence, and reach of eCommerce, Big Tech, and social giants grows, there is risk of a redesign of the specialty marketplace.

- Specialty market size/growth and enthusiast engagement is critical to long-term sustainability. There is a certain graying of our industry, with the reality being that we’re also competing with other viable options available to a younger consumer. We, as an industry, must make sure we’re keeping pace, onboarding younger consumers, and expanding our market and product offerings to include lifestyle and other adjacent enthusiast activities.

- What is the lasting impact of the COVID-19 era on our industry and members, thus the backbone of what drives creativity and innovation? In our business, we’ve seen many changes in behaviors and patterns from our suppliers and customers. At Keystone, that prompted us to evaluate our processes, approach, and systems then make necessary, permanent changes to keep pace. This, coupled with the exaggerated demand brought on by deep supply chain voids, could drive an over-correction and eventually put companies at risk based on too many adjustments from this “false demand” and short-term elevated market conditions.

It’s in the best interest of SEMA, specifically its board, to understand, educate, and drive improvements through the membership to ensure the necessary adjustments are being made to thrive in a world post-pandemic.

Q: People want to see real progress, real change, real results, and real security, but things tend to move at a glacial pace within any large establishment. To make good on your campaign promise of “a man of action” and “no tolerance for bureaucracy,” how will you circumvent any bureaucracy and hold the organization more accountable to its membership?

A: The first step is to always understand what drives actions and accountability within any organization, which includes at the board level. I want to better understand what the metrics and processes are around driving results at SEMA. Are there yearly plans with goals and objectives, to what extent, and how are they reviewed, how often, and what are the action plans?

We’re obligated as an industry organization to publicize our measures and keep the membership updated regarding where different initiatives stand – good, bad, or otherwise. Healthy discussions at the leadership level, transparency, and accountability are important, as is a willingness to adjust what isn’t working.

Q: At times, it appears like there’s an uneven playing field between the OEMs and the aftermarket. OEMs eagerly tap into the vast knowledge and resources of the aftermarket, while consistently creating other obstacles to overcome. As one example: encrypting telematics data and building software designed to challenge aftermarket parts by removing OBDII ports from vehicles.

That said, SEMA has always had a unique relationship with the OEMs. In recent years, SEMA has been receptive to OEMs having a larger, more prominent role at the annual SEMA Show, as well as in other areas of the organization and business at large as well. Where’s the line?

A: SEMA has a broad membership and, over time, has maintained balance on complicated topics just like this because, surely, it doesn’t want to upset the apple cart. The OEMs are a large revenue driver at the SEMA Shows and, of course, a big attraction. But the flip side of that is exactly what you said – what’s the impact of the relationship? The OEMs need to be a part of the overall picture, for sure, but there needs to be a balance. Because the fact of the matter is: I’ve never known an OE to be the leader in enthusiast parts. Product innovation comes from the aftermarket and then works its way back into the vehicle models a couple years down the line. So, yes, I would pursue a better understanding of the role the OEMs currently play within SEMA, and make sure we push for a more collaborative partnership that will support the longevity of the aftermarket.

Q: Obviously, change lends valuable knowledge. The past 12-18 months have revealed some harsh truths about the industry and the larger economy. What do you believe are some important takeaways for automotive professionals? What are some lessons you personally learned along the way?

A: The supply chain was and continues to be a big challenge to navigate. There’s definitely been some lessons learned across the distribution channel, and its relevance within the supply chain. Some businesses felt they could do a lot themselves and placed little value on the standard supply chain pre-pandemic, but the past 12 months have highlighted the importance of a manufacturer being a manufacturer and the important role distribution plays in the supply chain. Those lines got a little less blurry, I think.

We’ve seen consumer preferences change at a rapid pace. The pandemic presented risk and opportunity. Those not embracing change and failing to evolve by, for example, not offering Buy Online Pickup In-Store or curbside services, are struggling and falling behind. Those figuring out how to adjust and, more importantly, cater to new consumer preferences, are doing well. Business owners adopting technological solutions, remaining flexible, and modifying their approaches accordingly are making the most of a difficult situation – and in some cases, really thriving.

A personal lesson learned is, as an organization, you can’t be risk averse to everything. From a business standpoint, right now we need to be more flexible. There was no playbook at the beginning of all this, and there’s still no playbook today. We’re all learning and growing from how the past 12-18 months have affected our businesses and will continue to do so well into the future.

My advice: look at things from a different lens. Don’t sit on important decisions – make the best call when you have to and make adjustments thereafter. Be supportive, communicate, stay transparent, and continuously evaluate, analyze, readjust, and repeat.

Despite many, many challenges, there’s a lot of good coming from a tough year. We’re on the upswing – preparing for the opportunities ahead and any threats that stand in the way. This is the mentality I bring to a SEMA board nomination.

Learn more about Larry’s vision for the automotive industry by visiting his website at larry4sema.com and Facebook page www.facebook.com/Larry4SEMA.

0 Comments